Consolidated with Numerous Monikers and Aliases RTP® Bank Depository Account Instead of Multiple RTP® Accounts with Numerous Financial Institutions

Unify Multiple RTP® Accounts Under One Platform

Streamline Your RTP® Transactions with Consolidated Accounts

Managing multiple Real-Time Payments (RTP®) accounts across different financial institutions can be complex. Businesses often face challenges in keeping track of multiple banking credentials, reconciling payments, and ensuring seamless cash flow management. Instead of handling multiple RTP® accounts separately, businesses can now consolidate them into a single bank depository account using Monikers and Aliases.

At TodayPayments.com, we provide a smart and efficient RTP® payment processing solution, allowing businesses to use mobile phone numbers or email aliases instead of full banking details for sending and receiving payments. This not only increases security but also simplifies financial management while ensuring instant real-time payments across multiple banks and credit unions.

Send and Receive Payments Using a Mobile Number or Email Alias

Consolidated with Numerous Monikers and Aliases RTP® Bank Depository Account Instead of Multiple RTP® Accounts with Numerous Financial Institutions

Unify Multiple RTP® Accounts Under One Platform

Managing several RTP® accounts at different financial institutions can lead to inefficiencies and higher operational costs. By consolidating multiple RTP® accounts into a single unified financial system, businesses can ensure better control, faster processing, and improved cash flow visibility.

Send and Receive Payments Using a Mobile Number or Email Alias

With RTP®, businesses no longer need to share sensitive banking details. Instead, transactions can be processed securely using a mobile number or email address, making payments faster, safer, and more convenient.

Manage RTP® Transactions Across Multiple Banks in One Dashboard

Our platform provides a centralized dashboard, enabling businesses to link and manage multiple RTP® accounts from different banks and credit unions, ensuring seamless financial management and real-time transaction tracking.

Comprehensive RTP® Merchant Services by TodayPayments.com

Instant Approval for RTP® and FedNow® Merchant Accounts

We provide merchant accounts for both RTP® and FedNow®, ensuring businesses can process instant real-time payments across multiple financial networks without delays.

Multi-Bank Integration for RTP® Transactions

Instead of using separate platforms for different banks, businesses can connect multiple financial institutions under one RTP® account, simplifying fund transfers and reconciliation.

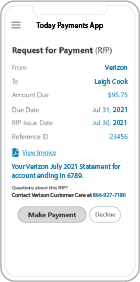

Custom Hosted Payment Pages for Request for Payments (RfP)

We provide businesses with custom-branded hosted payment pages, allowing them to send payment requests and invoices through mobile, email, or SMS, ensuring a professional and seamless customer payment experience.

![]()

✅

"FREE" Real-Time Payments Bank Reconciliation – with all merchants process with us.

Businesses can track, verify, and reconcile RTP® transactions in real-time, eliminating errors and enhancing financial transparency.

Step-by-Step Guide for U.S. Merchants to Consolidate Multiple RTP® Accounts

✅ Visit TodayPayments.com and

complete the RTP® application online

✅

Register a mobile phone number or email alias for secure RTP®

transactions

✅ Link multiple RTP® accounts

from different banks into a single dashboard

✅

Integrate RTP® transactions with QuickBooks® QBO for automated

reconciliation

✅ Start accepting RTP®

payments instantly via mobile, email, or SMS

Key Benefits of Using TodayPayments.com for RTP® Consolidation

Lower Banking Fees and Reduced Transaction Costs

By consolidating multiple RTP® accounts into a single depository account, businesses can reduce banking fees and operational costs, improving overall financial efficiency.

⚡ Instant Transactions for Faster Cash Flow

With 24/7 real-time processing, businesses can receive funds instantly, avoiding the delays of traditional payment methods.

100% Digital Enrollment – No Bank Visits Required

Merchants can apply for an RTP® account entirely online, avoiding the hassle of physical paperwork and manual approvals.

Enhanced Security with Alias-Based Processing

Using a mobile phone number or email alias instead of a full banking account protects financial data, reduces fraud risks, and ensures transaction security.

Multiple MIDs for Business Structuring

Merchants can assign unique Merchant Identification Numbers (MIDs) for different store locations, subsidiaries, or departments, ensuring structured and organized payment processing.

24/7/365 RTP® Payment Processing

Unlike traditional banking hours, RTP® transactions can be processed at any time, including weekends and holidays, ensuring continuous business operations without payment delays.

Industries That Benefit from RTP® Consolidation

Retail & E-Commerce

Retailers can streamline checkout experiences with instant RTP® transactions, improving customer satisfaction and reducing processing times.

Business-to-Business (B2B) Payments

RTP® simplifies vendor payments and supplier transactions, eliminating delays and improving financial efficiency.

Subscription & Membership-Based Businesses

Subscription-based businesses can automate recurring RTP® payments, ensuring seamless billing cycles and increased customer retention.

Freelancers & Independent Contractors

Freelancers can receive payments instantly from clients, eliminating waiting periods and ensuring faster access to funds.

High-Risk Businesses

Businesses facing banking restrictions or limitations can use RTP® as an alternative payment method, ensuring uninterrupted financial transactions.

Start Accepting RTP® Payments with TodayPayments.com

Managing multiple RTP® accounts separately can be complex and costly. TodayPayments.com offers a smarter way to consolidate your RTP® transactions into a single streamlined financial platform.

✔️ Merge multiple RTP®

accounts under one system for improved management

✔️

Send and receive RTP® payments using only a mobile number or

email alias

✔️ Reduce banking fees and

transaction costs

✔️ Automate

reconciliation with QuickBooks® QBO integration

✔️

Sign up online and start processing RTP® payments today

Unlock the full potential of real-time payments with TodayPayments.com – the ultimate solution for RTP® consolidation and instant payment processing!

Creation Request for Payment Bank File

Enhance Your FedNow Application using Real-Time Payments Requests with FedNow’s ISO 20022 Messaging

Streamline Payments with Advanced Request for Payment Options:

Harness the power of FedNow's Request for Payment system to transform how you manage invoices and remittances. Our platform supports diverse data integration options, allowing payees to incorporate detailed invoice data directly within the RfP message or link to a comprehensive Merchant Page.

Flexible Invoice Details with ISO 20022 Messaging:

Leverage the flexibility of ISO 20022 messaging standards in our RfP system. You can choose to display crucial payment details directly in the message with a concise 140-character description, or through a dynamic "Hyper-Link" leading to a detailed Merchant Page. This Merchant Page can be hosted either on your website "Your Website" - Hosted Payments Page or TodayPayments.com/HostedPaymentPage.html through our seamless integration solution.

Customizable Merchant Pages for Enhanced Customer Experience:

Create a Merchant Page that not only details all the MIDs you own but also presents these options attractively to your customers through the RfP. This customization ensures that whether your payer opts for Real-Time Payment, Same-Day ACH, or Card transactions, they can easily navigate and complete their payments through a simple click on the hyperlink provided on your Merchant Page.

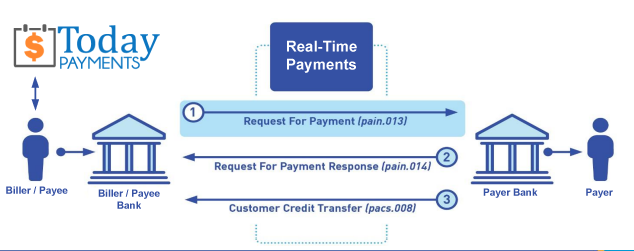

Call us today and receive the .csv or .xml FedNow® or Request for Payment (RfP) file you need—all during your very first phone call! We guarantee that our comprehensive reports integrate flawlessly with your bank or credit union. As pioneers in recognizing the benefits of RequestForPayment.com, we have stayed years ahead of our competitors. Although we are not a bank, our role as an "Accounting System" within the Open Banking ecosystem enables us to work with billers to create effective RfP files that seamlessly upload to the biller's online banking platform. U.S. companies rely on our expertise to learn how to deliver the RfP message directly to their bank with precision.

Our advanced solution, Today Payments' ISO 20022 Payment Initiation (PAIN.013), demonstrates how to create a Real-Time Payments Request for Payment file that sends a clear message from the creditor (payee) to its bank. Most financial institutions support the import of messaging and batch files for both FedNow® and Real-Time Payments (RtP), ensuring smooth processing. Once the file is correctly uploaded, the creditor’s bank processes the payment through a secure "Payment Hub"—with The Clearing House serving as the RtP Hub—and relays the message to the debtor's (payer's) bank. This streamlined approach not only accelerates transaction processing but also enhances transparency and reliability for all parties involved.

... easily create Real-Time Payments RfP files. No risk. Test with your bank and delete "test" files before APPROVAL on your Bank's Online Payments Platform.

Today Payments is a leader in the evolution of immediate payments. We were years ahead of competitors recognizing the benefits of Same-Day ACH

and Real-Time Payments funding. Our business clients receive faster

availability of funds on deposited items and instant notification of

items presented for deposit all based on real-time activity.

Dedicated to providing superior customer service and

industry-leading technology.

Contact Us for Request For Payment payment processing